zomerstorm.online News

News

Best Site To Do Taxes On

TaxSlayer helps you easily file your federal and state taxes online. Learn about our tax preparation services and get started for free today! TaxSlayer Pro Classic includes everything you need to prepare, file, and transmit your clients' tax returns. Pro Web Screen. Comprehensive bank product. TurboTax® is the #1 best-selling tax preparation software to file taxes online. Easily file federal and state income tax returns with % accuracy to get. Tax e-Services > File My Taxes (PA e-File). Begin Main Content Area. Page Proudly founded in as a place of tolerance and freedom. TOP SERVICES. TurboTax: File Your Tax Return 4+. E-file Taxes & Get Your Refund. Intuit Inc. • Prepare your taxes online with Jackson Hewitt's easy to use tax filing software. Backed by industry leading guarantees. % free federal tax filing. E-File your tax return directly to the IRS. Prepare federal and state income taxes online. tax preparation software. File on FreeTaxUSA. File your taxes online using FreeTaxUSA's prior year tax software. You can prepare and mail tax returns. Standout features: TaxSlayer provides a maximum refund and a % accuracy guarantee. You can also file your taxes on the go through the mobile app. TaxSlayer helps you easily file your federal and state taxes online. Learn about our tax preparation services and get started for free today! TaxSlayer Pro Classic includes everything you need to prepare, file, and transmit your clients' tax returns. Pro Web Screen. Comprehensive bank product. TurboTax® is the #1 best-selling tax preparation software to file taxes online. Easily file federal and state income tax returns with % accuracy to get. Tax e-Services > File My Taxes (PA e-File). Begin Main Content Area. Page Proudly founded in as a place of tolerance and freedom. TOP SERVICES. TurboTax: File Your Tax Return 4+. E-file Taxes & Get Your Refund. Intuit Inc. • Prepare your taxes online with Jackson Hewitt's easy to use tax filing software. Backed by industry leading guarantees. % free federal tax filing. E-File your tax return directly to the IRS. Prepare federal and state income taxes online. tax preparation software. File on FreeTaxUSA. File your taxes online using FreeTaxUSA's prior year tax software. You can prepare and mail tax returns. Standout features: TaxSlayer provides a maximum refund and a % accuracy guarantee. You can also file your taxes on the go through the mobile app.

$0. No, Really. MilTax is Like No Other. · Complete your tax return with specialized software that accounts for the complexities of military life · Connect with a. If you think you will owe taxes, it is a good idea to make an estimated payment. · If you don't owe taxes, you will not be penalized for filing late if you. Get more with Jackson Hewitt tax preparation services. We're open late and weekends. Our Tax Pros service in nearly locations, with in Walmart. MilTax is a suite of free tax services for the military community, including personalized support from tax consultants, easy-to-use tax preparation and e-. Below are IRS Free File tax preparation and filing services from trusted partners for you to explore. For best results, use the IRS Free File "Find Your Trusted. IBM WebSphere Portal. An official State of Ohio site. Here's how you OH|TAX - File Now. {}. Web Content Viewer. Actions. TAX · Individuals · File Now; OH. We began our analysis by looking at nine popular online tax software providers: Cash App Taxes, zomerstorm.online, Free Tax USA, File Your Taxes, H&R Block, TurboTax. As an IRS-sponsored and certified Volunteer Income Tax Assistance (VITA) provider, Food Bank's team of experienced professionals provides you with top-notch tax. E-File your tax return directly to the IRS for free. Prepare federal and state income taxes online. tax preparation software. File your taxes for free with H&R Block Free Online. eFile taxes with our DIY free online tax filing service and receive the guaranteed max refund you. H&R Block is our pick for the best overall tax preparation service due to its large network of branches that offer several tax preparation and filing options. File your taxes for free. Choose the filing option that works best for you. · File My Own Taxes · Have My Taxes Prepared for Me · Required Information · Credits. TaxSlayer offers an attractively priced online tax service aimed at do-it-yourself filers who need little or no expert assistance. Like many others, it has a. Online Taxes tax preparation service provides simple, fast and secure tax preparation software and online tax help for online filing of your income tax. E-file your federal and state taxes online with TaxAct. Explore tax products for a wide range of tax filing situations and get your maximum tax refund. "Stop shelling out for expensive tax software and let Cash App Taxes file your state and federal taxes for free." CHECK OUT THE ARTICLE. Icon for taxes page. I have used multiple tax softwares but Sprintax has been the best and never disappointed. This website uses cookies to help provide you with the best. File taxes for free with TurboTax Free Edition. ~37% of taxpayers qualify. Form & limited credits only. Get free help with your tax return. Know the steps to file your federal taxes, and how to contact the IRS if you need help.

How Avoid Pmi

The best way to avoid PMI is to make a down payment of at least 20% of the home's purchase price. If you don't have a big down payment, ask your lender about. PMI or Private Mortgage Insurance is insurance secured by your mortgage company when you are getting a conventional mortgage and putting less than 20% as a down. 5 ways to save money and avoid paying PMI · 1. Shop around for a loan that doesn't require PMI · 2. Check out state and local homebuyer assistance programs · 3. How to Remove PMI In today's housing market, however, there is an opportunity for current homeowners to eliminate PMI on their mortgage by refinancing their. Avoiding private mortgage insurance (PMI) is possible. One way to avoid paying this extra fee is anticipating your home value's appreciation. Unlike insurance policies designed to protect you and your loved ones from life's unexpected perils, PMI exists solely to protect the mortgage lender. In the. What is PMI? If you are buying a home and do not have enough money saved for a 20% down payment, most lenders will ask you to secure Private. Pay 20% of The Down Payment. The most surefire way to avoid paying PMI is also the simplest, namely, paying at least 20% on the down payment of your new home. Another option is to refinance into a new conventional loan. If you have at least 20% in home equity, you can avoid PMI payments on the new loan; just be sure. The best way to avoid PMI is to make a down payment of at least 20% of the home's purchase price. If you don't have a big down payment, ask your lender about. PMI or Private Mortgage Insurance is insurance secured by your mortgage company when you are getting a conventional mortgage and putting less than 20% as a down. 5 ways to save money and avoid paying PMI · 1. Shop around for a loan that doesn't require PMI · 2. Check out state and local homebuyer assistance programs · 3. How to Remove PMI In today's housing market, however, there is an opportunity for current homeowners to eliminate PMI on their mortgage by refinancing their. Avoiding private mortgage insurance (PMI) is possible. One way to avoid paying this extra fee is anticipating your home value's appreciation. Unlike insurance policies designed to protect you and your loved ones from life's unexpected perils, PMI exists solely to protect the mortgage lender. In the. What is PMI? If you are buying a home and do not have enough money saved for a 20% down payment, most lenders will ask you to secure Private. Pay 20% of The Down Payment. The most surefire way to avoid paying PMI is also the simplest, namely, paying at least 20% on the down payment of your new home. Another option is to refinance into a new conventional loan. If you have at least 20% in home equity, you can avoid PMI payments on the new loan; just be sure.

One of the most straightforward ways to avoid PMI is by making a down payment of 20% or more. This reduces the lender's risk, eliminating the need for insurance. But it is possible for prospective home buyers to avoid PMI, even with a less-than% down payment. Low down payment programs, piggyback loans, home. How to Avoid Paying PMI · Make a down payment of 20% or more. · Apply for a VA loan (if eligible). A VA loan however only avoids the monthly mortgage insurance. 5 ways to save money and avoid paying PMI · 1. Shop around for a loan that doesn't require PMI · 2. Check out state and local homebuyer assistance programs · 3. You can avoid PMI by putting 20% down. If you have PMI then once you have paid down a certain % of the principal on the loan the PMI will be. If your payments are current and in good standing, your lender is required to cancel your PMI on the date your loan is scheduled to reach 78% of the original. The best way to avoid PMI is to save up your money until you can put 20 percent down on the house. PMI is not required if you pay the 20 percent down. How to remove PMI. Generally, once you reach 20% equity or when you pay your loan balance down to 80% of the purchase price of your home, you. Private mortgage insurance (PMI) is a cost you pay when you take out a conventional mortgage and your down payment is less than 20%. Because the lender is. Buyers putting down less than 20% are required to pay Private Mortgage Insurance (PMI) monthly until they build up 20% equity in their home. Did you know? The. FHA loans require Mortgage Insurance Premiums (MIP), which consist of an upfront premium and an annual premium. This is different from conventional loans, where. 5 ways to avoid or reduce PMI · Make a larger down payment. Begin saving for a down payment long before you apply for a loan. · Pay more on your mortgage. If you. Unlike insurance policies designed to protect you and your loved ones from life's unexpected perils, PMI exists solely to protect the mortgage lender. In the. To avoid PMI completely with a conventional loan, you'll need a minimum 20% down payment, or 15% with CCM's Bye-Bye PMI loan program. How does. Put 20% down. · If you accept a higher interest rate on your mortgage loan, you could avoid PMI. · Consider a purchase Home Equity Line Of Credit (HELOC). Once you've built equity of 20% in your home, you can cancel your PMI and remove that expense from your monthly payment. If you're current on your mortgage. Mortgage insurance is added to help the lender with any losses they incur in case a borrower doesn't pay the loan back. PMI also applies to homeowners who don't. FHA always requires all borrowers to pay PMI regardless of equity position. If you are considering paying down your mortgage to avoid PMI you. Avoiding PMI. There are several ways to get around PMI. Sometimes lenders will offer conventional loans that don't require PMI if you have a small down payment. Private mortgage insurance (PMI) protects your lender if you default on your mortgage. · Some lenders, like Navy Federal, may offer mortgages that don't require.

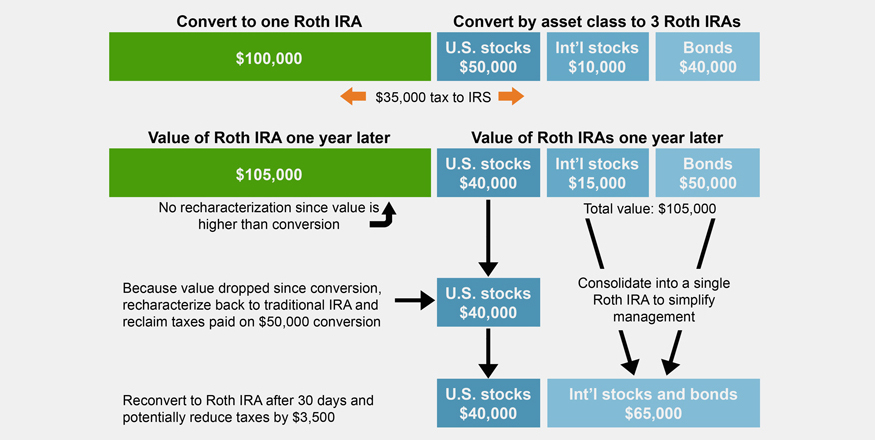

Tax On Conversion From Traditional To Roth Ira

), a conversion from a traditional IRA, SEP or SIMPLE to a Roth IRA cannot be recharacterized. The new law also prohibits recharacterizing amounts rolled. You must pay taxes on the amount converted, although part of the conversion will be tax-free if you have made nondeductible contributions to your traditional. Some withdrawals may be taxable, and some may be subject to a 10% early withdrawal penalty. SIMPLE IRA conversions before the age of 59½ are subject to a 10%. If you choose to convert a traditional IRA to a Roth IRA, timing matters. You'll have to pay taxes on the amount you convert at your regular income tax rate. To. In this case, you will pay $2, in taxes to do the conversion. If in the future your IRA withdrawals would be subject to 22% income tax rate, you would pay. The taxes will be calculated based on your marginal income tax bracket and the amount of money you convert from your Traditional IRA or employer plan assets. Why you might convert a traditional IRA to a Roth IRA · Enjoy tax-free withdrawals in retirement · Watch your money grow tax-free for longer · Leave a tax-free. Because converting will require you to pay taxes on the amount converted, we'll help you compare the impact of paying taxes on the converted amount today vs. A conversion to a Roth IRA results in taxation of any untaxed amounts in the traditional IRA. The conversion is reported on Form PDF PDF, Nondeductible. ), a conversion from a traditional IRA, SEP or SIMPLE to a Roth IRA cannot be recharacterized. The new law also prohibits recharacterizing amounts rolled. You must pay taxes on the amount converted, although part of the conversion will be tax-free if you have made nondeductible contributions to your traditional. Some withdrawals may be taxable, and some may be subject to a 10% early withdrawal penalty. SIMPLE IRA conversions before the age of 59½ are subject to a 10%. If you choose to convert a traditional IRA to a Roth IRA, timing matters. You'll have to pay taxes on the amount you convert at your regular income tax rate. To. In this case, you will pay $2, in taxes to do the conversion. If in the future your IRA withdrawals would be subject to 22% income tax rate, you would pay. The taxes will be calculated based on your marginal income tax bracket and the amount of money you convert from your Traditional IRA or employer plan assets. Why you might convert a traditional IRA to a Roth IRA · Enjoy tax-free withdrawals in retirement · Watch your money grow tax-free for longer · Leave a tax-free. Because converting will require you to pay taxes on the amount converted, we'll help you compare the impact of paying taxes on the converted amount today vs. A conversion to a Roth IRA results in taxation of any untaxed amounts in the traditional IRA. The conversion is reported on Form PDF PDF, Nondeductible.

because the qualified distributions are tax-free, a distribution from a Roth IRA as opposed to a traditional IRA might keep a taxpayer in a lower tax bracket. A Roth conversion occurs when you move funds from a traditional individual retirement account (IRA) to a Roth IRA. With a Roth conversion, you pay taxes now to. In contrast to a traditional IRA, amounts contributed to or converted to a Roth IRA are after-tax dollars that can always be withdrawn tax-free. Similar to a. A Roth conversion is a reportable movement of assets from a traditional/SEP/SIMPLE IRA or employer qualified plan to a Roth IRA. While converted amounts are considered taxable, there is no 10% early withdrawal penalty tax on any amount you convert from a traditional to a Roth IRA. •. The full distribution does not need to be converted to a Roth IRA. Conversions must be reported on Form , Part II. Form R must be entered into the tax. The original conversion from a Traditional IRA to a Roth IRA must be completed within 60 days after the end of the tax year. A distribution from an IRA is. The taxes will be calculated based on your marginal income tax bracket and the amount of money you convert from your traditional IRA or employer plan assets. If. As long as taxes are paid on the conversion (i.e., pre-tax) amount, anyone can convert a traditional IRA, or other eligible retirement plan asset,Footnote 1 to. How much tax will you owe? When you convert to a Roth IRA, you must pay tax on the funds transferred, just like a traditional IRA distribution. If your account. Roth IRA conversions require a 5-year holding period before earnings can be withdrawn tax-free and subsequent conversions will require their own 5-year holding. When you convert from a traditional IRA to a Roth, there's a tradeoff. You will face a tax bill—possibly a big one—as a result of the conversion, but you'll be. The converted Roth IRA balance will be reduced by the tax liability on day one. The only way to have the BETR change from the “current tax rate”, when paying. An amount in a traditional IRA may be converted to an amount in a Roth IRA if two requirements are satisfied. Conversions from a Traditional IRA to a Roth are generally subject to ordinary income taxes. Please consult with a tax advisor regarding your particular. If you are under age 59½, you may be subject to a 10% federal tax penalty if you withdraw money from your traditional IRA to pay the tax on the conversion. You. A conversion to a Roth IRA results in taxation of any untaxed amounts from the traditional IRA. The conversion will be reported on Form , Nondeductible. As part of the conversion, individuals will have to pay income taxes on the taxable amount, if any, of the Traditional IRA converted to a Roth IRA. The. On April 5, you could convert your traditional IRA to a Roth IRA. However, the conversion can't be reported on your taxes. Because IRA conversions are only. Because, when you convert your traditional plan to a Roth, you have to pay taxes on it since you didn't pay taxes on that money when you first contributed it.

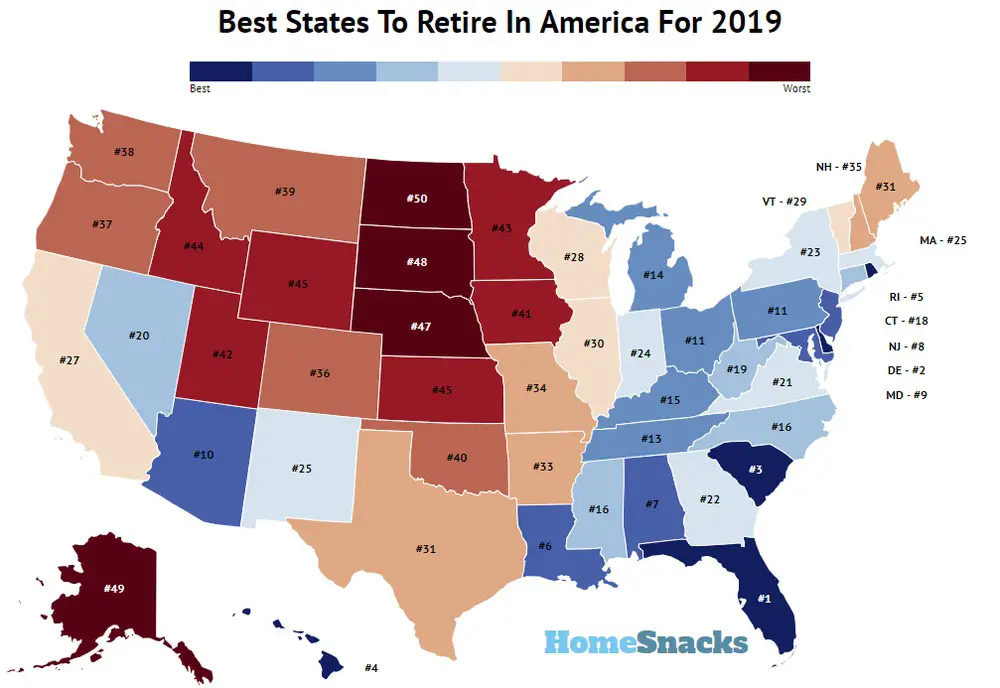

Best States To Retire For Taxes And Weather

Additionally, Florida has no state income tax and ranks a respectable No. 26 for its health care system, according to U.S. News & World Report. Moreover. Florida's appeal as a retirement destination is undeniable. With its favorable rankings across multiple categories, weather, low taxes, and numerous. Of all the states that won't take a cut of traditional retirement income, Mississippi has the lowest property taxes, with a median tax bill of $1, So. “While Delaware is a pricier state to live in, the state's high-quality healthcare, light tax burden, affordable homeowners insurance and good weather propelled. 45 votes, comments. Curious what you think about your state/city for early retirement? Some considerations I have: property taxes;. With over 20% of citizens age 65+, the state has lots to entice a retiring population, with miles of beaches, golf courses, and excellent tax benefits: there. For instance, states like Florida, Texas, and Nevada boast no state income tax, making them popular choices among retirees. But remember, it's not just about. What States Are Retirees Moving to Right Now? South Carolina is a hot destination for newly relocating retired Americans in Florida remained the top. Most Tax-Friendly States for Retirement · 1. Mississippi · 2. Tennessee · 3. Wyoming · 4. Nevada · 5. Florida · 6. South Dakota · 7. Iowa · 8. Pennsylvania. Additionally, Florida has no state income tax and ranks a respectable No. 26 for its health care system, according to U.S. News & World Report. Moreover. Florida's appeal as a retirement destination is undeniable. With its favorable rankings across multiple categories, weather, low taxes, and numerous. Of all the states that won't take a cut of traditional retirement income, Mississippi has the lowest property taxes, with a median tax bill of $1, So. “While Delaware is a pricier state to live in, the state's high-quality healthcare, light tax burden, affordable homeowners insurance and good weather propelled. 45 votes, comments. Curious what you think about your state/city for early retirement? Some considerations I have: property taxes;. With over 20% of citizens age 65+, the state has lots to entice a retiring population, with miles of beaches, golf courses, and excellent tax benefits: there. For instance, states like Florida, Texas, and Nevada boast no state income tax, making them popular choices among retirees. But remember, it's not just about. What States Are Retirees Moving to Right Now? South Carolina is a hot destination for newly relocating retired Americans in Florida remained the top. Most Tax-Friendly States for Retirement · 1. Mississippi · 2. Tennessee · 3. Wyoming · 4. Nevada · 5. Florida · 6. South Dakota · 7. Iowa · 8. Pennsylvania.

Texas, Florida, and Nevada all offer places with low population density and good weather. In my hometown in Texas, I used to drive around during. What Are The Most Tax-Friendly States for Retirees? · Alaska: Although Alaska has some of the highest sales taxes, there's no income tax, and residents are. There are so many reasons why retirees love South Carolina. The state is a popular retirement destination thanks to its amazing weather, culture, and outdoor. Among seniors, it comes as no surprise that Arizona, Alabama, Florida, New Mexico, South Carolina, West Virginia and Wyoming dominated the top ten list in the. The top two states to retire in according to our formula are — drumroll please — Alaska and New Hampshire! Alaska has the lowest tax burden of any state at There's a reason Arizona is a haven for retirees. They can escape the cold weather and a big tax bill by moving here. Its income tax rate is among the lowest in. Pennsylvania provides a tax-friendly climate for retirees. If you've asked yourself the question, “does Pennsylvania tax retirement income?”, then the answer is. Nevada may be best known for its casino-based tourism industry, but it's also a haven for those looking for a tax-friendly retirement and access to outdoor. Top reasons to retire in Arizona · Other retirees are doing it—at the second-highest rate · Arizona is a moderately tax-friendly state · Low property taxes. A related example. California is seen as a "high tax" state. But similar to MN, it has progressive taxes so it really depends on your income. If. South Dakota ranks as the best state for retirement in the United States. The average cost of living in South Dakota is 4% below the national average, including. Some of the best states for retirement taxes include Florida, synonymous with retirees, Nevada, Alaska, Georgia, and more. Learn for yourself about. Some of the best states for retirement taxes include Florida, synonymous with retirees, Nevada, Alaska, Georgia, and more. Learn for yourself about. If you can brave the cold (and extreme daylight/nighttime swings in summer and winter), retired Alaskans enjoy no state income tax, no taxes on social security. If you can brave the cold (and extreme daylight/nighttime swings in summer and winter), retired Alaskans enjoy no state income tax, no taxes on social security. The state of California doesn't include Social Security retirement benefits in its income tax rates, but other forms of income can be subject to taxation, which. Retirement account withdrawals and private and public income are only partially taxed. Delaware also has no state or local sales tax. To top it off, property. New Hampshire is also the only state with no general sales tax and limited state income taxes (a 5% tax on dividends and interest income above $2, for. Besides the warm weather, Alabama is a good place to retire. Though you will owe income taxes on IRA and (k) distributions, you will be exempted from paying.

Amboy Bank Money Market Rates

Use our free calculators to see how saving money early can add up. Set your financial goals and explore Amboy Bank's CDs and savings accounts. Meet with dedicated specialists who focus on providing the advice and guidance you need, wherever you may be in your financial life. From your personal accounts. Balances from $30, - $, earn % Annual Percentage Yield (APY); $5, - $29, earns % APY; under $5, earns no interest. Competitor. interest paid quarterly * Money Market - minimum opening balance $2, - interest paid on daily balance method - interest rates are variable and subject. We use the mid-market rate and show fees upfront, so you'll know exactly how much it'll cost before you hit send. Wise supports international money. Rewards Checking* Learn more. TIER, INTEREST RATE, APY. $0 - $10,, %, %. $10,+, %. Amboy offers a variety of savings accounts so that we can serve your individual needs. Earn interest on as little as $; Tiered rate levels; 3 free. Rates valid as of 9/6/ Offer may be withdrawn at any time. For % annual percentage rate (APR) year loan, the biweekly P&I payment per $1, is. Guaranteed % APY for 12 months! Transfer your low rate checking, savings, and money market deposits to a higher yielding Business Money Market Maximizer. Use our free calculators to see how saving money early can add up. Set your financial goals and explore Amboy Bank's CDs and savings accounts. Meet with dedicated specialists who focus on providing the advice and guidance you need, wherever you may be in your financial life. From your personal accounts. Balances from $30, - $, earn % Annual Percentage Yield (APY); $5, - $29, earns % APY; under $5, earns no interest. Competitor. interest paid quarterly * Money Market - minimum opening balance $2, - interest paid on daily balance method - interest rates are variable and subject. We use the mid-market rate and show fees upfront, so you'll know exactly how much it'll cost before you hit send. Wise supports international money. Rewards Checking* Learn more. TIER, INTEREST RATE, APY. $0 - $10,, %, %. $10,+, %. Amboy offers a variety of savings accounts so that we can serve your individual needs. Earn interest on as little as $; Tiered rate levels; 3 free. Rates valid as of 9/6/ Offer may be withdrawn at any time. For % annual percentage rate (APR) year loan, the biweekly P&I payment per $1, is. Guaranteed % APY for 12 months! Transfer your low rate checking, savings, and money market deposits to a higher yielding Business Money Market Maximizer.

Amboy Bank offers a variety of deposit and lending accounts in our 20+ branches in Central New Jersey Money Market & IRA · Ways to Bank with Us. Borrowing. Deposit Rates - September 9, ; Jersey First eSavings. %, $1 ; Money Market Money Market Max More, %, $30, Business Interest Checking · Interest paid on balances of $5, and more · Avoid $15 monthly fee with $1, minimum balance · First transactions are free. In this example, the advertised APY must be computed by applying the 7% interest rate for the first three months and by applying the current 5% variable rate. With our IRA Money Market, you can stop the hassle and expense of continually shopping and moving your funds. Visit our NJ branches. Bank of America financial center is located at Smith St Perth Amboy, NJ Our branch conveniently offers walk-up ATM services. In this example, the advertised APY must be computed by applying the 7% interest rate for the first three months and by applying the current 5% variable rate. Certificate of Deposit ; 3 Year Certificate, , ; 5 Year Certificate, , ; Money Market Account* Minimum to Open $2, ; Daily Balance $2, or. AloStar – % APY*. Term (months): 5; Minimum deposit: $10,; Early withdrawal penalty: 3 months of interest; Overview: AloStar was established as AloStar. Advertised APY % is for tier $25, - $99, Popular Bank, in its sole discretion, reserves the right to change or terminate these rates at any time. Elevate your earnings with this tiered money market account designed for businesses. Earn interest on as little as $2,; Avoid monthly fee of $10 with $5, Deposit Rates ; Money Market Account* Minimum to Open $2, ; Daily Balance $2, or less ; Daily Balance between $2, and $24, About Datatrac · $15 is the difference between the amount earned in interest between Amboy Bank's rate at % APR compared to % APR for the Red Bank, NJ. Online Only Savings Rates of Amboy Direct. Online Savings Rates, APY Ally Lowers Online Savings and Online Money Market Rates to % APY - Mar 16, accounts online and transacting digitally. Because Amboy Direct clients do not use branches, we can pay higher rates on Money Markets and CDs; Accounts. Advantage Checking. Our Advantage Checking account pays interest and comes with other special benefits that are part of the Amboy Advantage Banking package.*. Bank of America financial center is located at Smith St Perth Amboy, NJ Our branch conveniently offers walk-up ATM services. interest paid quarterly * Money Market - minimum opening balance $2, - interest paid on daily balance method - interest rates are variable and subject. $1, is the difference between the amount earned in interest between Amboy Bank's rate at % APR compared to % APR for the New Jersey market average. Colorado Federal Savings Bank – % APY · Term (months): 12 · Minimum deposit: $5, · Early withdrawal penalty: 3 months of interest · Overview: Colorado.

Winners In The Stock Market Today

S&P Market Movers. Find the S&P hot stocks to buy today. S&P Top market gainers and losers today. Recent News ; Dow Jones Futures: S&P Power Trend Starts; Tesla Rival Leads 7 Stocks In. APP. triangle green. %. Stock Market Today PM ET ; Tesla Rival. World markets ; Dow. United States. 41, ; S&P United States. 5, ; NASDAQ. United States. 17, ; VIX. United States. ; Russell Market Movers. Gainers · Losers · Active · Premarket · After Hours · Today · Week · Month Stock Price, Volume, Market Cap. 1, AAM, AA Mission Acquisition Corp. Stocks with 5 consecutive days of gains for the U.S. Market. 5-Day Gainers for NYSE, Nasdaq, NYSE Arca, OTC-US. Markets ; Most Active · NVIDIA Corp. $ ; Net Gainers · NVR Inc. $ ; % Gainers · Intel Corp. $ ; Net Losers · AutoZone Inc. $ ; % Losers · Ulta. Dow Jones - Top Gainers ; Walmart, , ; Johnson & Johnson, , ; Microsoft, , ; Procter &. market gainersPre-market losersPre-market most activePre US stocks that lost the most in price. US companies below are the biggest stock losers today. Today's top stock market movers. See the gainers and losers of the day including price action, trading volume and more. S&P Market Movers. Find the S&P hot stocks to buy today. S&P Top market gainers and losers today. Recent News ; Dow Jones Futures: S&P Power Trend Starts; Tesla Rival Leads 7 Stocks In. APP. triangle green. %. Stock Market Today PM ET ; Tesla Rival. World markets ; Dow. United States. 41, ; S&P United States. 5, ; NASDAQ. United States. 17, ; VIX. United States. ; Russell Market Movers. Gainers · Losers · Active · Premarket · After Hours · Today · Week · Month Stock Price, Volume, Market Cap. 1, AAM, AA Mission Acquisition Corp. Stocks with 5 consecutive days of gains for the U.S. Market. 5-Day Gainers for NYSE, Nasdaq, NYSE Arca, OTC-US. Markets ; Most Active · NVIDIA Corp. $ ; Net Gainers · NVR Inc. $ ; % Gainers · Intel Corp. $ ; Net Losers · AutoZone Inc. $ ; % Losers · Ulta. Dow Jones - Top Gainers ; Walmart, , ; Johnson & Johnson, , ; Microsoft, , ; Procter &. market gainersPre-market losersPre-market most activePre US stocks that lost the most in price. US companies below are the biggest stock losers today. Today's top stock market movers. See the gainers and losers of the day including price action, trading volume and more.

Stock Screener Stock Ideas Today's Top Gainers. Biggest Stock Gainers Today (Top Market Gainers). The stocks with the largest increases in price today on the. A quick review of these stock market movers can help explain what drove the overall market for the day (e.g. tech stocks, energy stocks, cyclical stocks, etc.). These stocks have had significant trading activity in the after hours session. Use the filters below to narrow results. Click to Expand or Collapse Filters. Discover the U.S. markets today with Fox Business. See the trending stocks in the USA stock market and today's stock market results. Top Gainers - United States Stocks ; Lexaria Bioscience. 30/08 |LEXX. + ; Singing Machine. 30/08 |MICS. + ; Compass Therapeutics,. 30/08 |. The top gaining stocks today in the USA (Nasdaq and NYSE exchanges). These are the stocks making the largest advance in the current or last trading session. The Stockhouse “Market-movers” page provides current data on prices and volume for top Canadian stocks, tracking both gains and declines for the most. Historical and current end-of-day data provided by FACTSET. All quotes are in local exchange time. Real-time last sale data for U.S. stock quotes reflect trades. Stock Market Trends. View All · Is the Stock Market Open Today? Carole Hodorowicz Sep 1, Market Movers. View All. Gainers. Losers. Actives. Rezolve AI. She is a two-time winner of the Kansas City Association of Black Journalists' President's Award. What Is the Average Stock Market Return? How to Make Money in. Markets ; Dow Jones Global. Dow Jones Industrial Average. 41, ; S&P US. S&P Index. 5, ; Nasdaq. NASDAQ Composite Index. 17, ; S&P Dow Jones. Yahoo Finance's list of top losing stocks, includes share price changes, trading volume, intraday highs and lows, and day charts for stocks posting the. Top Gainers US Stocks: Find the top gaining U.S stocks today - including Dow Jones, NASDAQ, S&P Stocks performance, technical chart & more. Worst Performing Stocks, Today ; Nucana Plc, % ; % ; Sunlands Technology Group, % ; %. Traders work on the floor of the New York Stock Exchange during morning trading on Stocks ticked lower on Tuesday, ending a winning streak as investors. Keep in mind that the biggest stock gainers today may be the worst-performing stocks tomorrow, and that past performance can't guarantee future results. Top Stocks.: Today's top winners and losers during market hours. Track stock futures and hot stocks of the day. PreMarket Market Hours After Hours. S&P The Advanced/Declined information is based on the percentage increase/decrease in stock price of Nasdaq Global and Global Select Market securities. Traders work on the floor of the New York Stock Exchange during morning trading on Stocks ticked lower on Tuesday, ending a winning streak as investors. Premarket Trading After Hours Trading Market Movers S&P Volume Burst Top Stock Gainers Today – INTC, MDB, and More TipRanksAug 30, AM ET.

Innovator Ibd Breakout Opportunities Etf

BOUT IBD® BREAKOUT OPPORTUNITIES ETF · EPRF INV. GRADE PREFERRED ETF · FFTY IBD Innovator's ETF Finder may be the ideal tool to make your search easier. View Innovator Etfs Trust Ibd Breakout Opportunities Etf (BOUT) stock price, news, historical charts, analyst ratings, financial information and quotes on. Find the latest quotes for Innovator IBD Breakout Opportunities ETF (BOUT) as well as ETF details, charts and news at zomerstorm.online This fund is provided by Innovator ETFs — which offers other funds with a total of +$ Bn in AuM. See all Innovator ETFs ETFs. Advertisement. Innovator IBD® Breakout Opps ETF (BOUT) is a passively managed U.S. Equity Mid-Cap Growth exchange-traded fund (ETF). Innovator ETFs launched the ETF in Innovator Ibd Breakout Opportunities ETF etfs funds price quote with latest real-time prices, charts, financials, latest news, technical analysis and. Get Innovator IBD Breakout Opportunities ETF (BOUT:NYSE Arca) real-time stock quotes, news, price and financial information from CNBC. BOUT: INNOVATOR IBD BREAKOUT OPPORTUNITIES ETF - Fund Holdings. Get up to date fund holdings for INNOVATOR IBD BREAKOUT OPPORTUNITIES ETF from Zacks. Innovator IBD Breakout Opportunities ETF (BOUT) - stock quote, history, news and other vital information to help you with your stock trading and investing. BOUT IBD® BREAKOUT OPPORTUNITIES ETF · EPRF INV. GRADE PREFERRED ETF · FFTY IBD Innovator's ETF Finder may be the ideal tool to make your search easier. View Innovator Etfs Trust Ibd Breakout Opportunities Etf (BOUT) stock price, news, historical charts, analyst ratings, financial information and quotes on. Find the latest quotes for Innovator IBD Breakout Opportunities ETF (BOUT) as well as ETF details, charts and news at zomerstorm.online This fund is provided by Innovator ETFs — which offers other funds with a total of +$ Bn in AuM. See all Innovator ETFs ETFs. Advertisement. Innovator IBD® Breakout Opps ETF (BOUT) is a passively managed U.S. Equity Mid-Cap Growth exchange-traded fund (ETF). Innovator ETFs launched the ETF in Innovator Ibd Breakout Opportunities ETF etfs funds price quote with latest real-time prices, charts, financials, latest news, technical analysis and. Get Innovator IBD Breakout Opportunities ETF (BOUT:NYSE Arca) real-time stock quotes, news, price and financial information from CNBC. BOUT: INNOVATOR IBD BREAKOUT OPPORTUNITIES ETF - Fund Holdings. Get up to date fund holdings for INNOVATOR IBD BREAKOUT OPPORTUNITIES ETF from Zacks. Innovator IBD Breakout Opportunities ETF (BOUT) - stock quote, history, news and other vital information to help you with your stock trading and investing.

Innovator IBD Breakout Opportunities ETF (BOUT). $ (%). As of August 22 PM EST. License Error: Access from crawling bot. ETF News on. Get the latest Innovator IBD Breakout Opportunities ETF (BOUT) fund price, news, buy or sell recommendation, and investing advice from Wall Street. The Innovator IBD Breakout Opportunities ETF (BOUT) is an exchange-traded fund that is based on the IBD Breakout Stocks Total Return index. The Innovator IBD Breakout Opportunities ETF seeks to provide exposure to the investment results of the IBD Breakout Stocks Index. It tracks the IBD Breakout Stocks Index, which selects stocks poised to break out, or experience a period of sustained price growth beyond the stock's. Innovator IBD Breakout Opportunities ETF As an aristocrat you get access to the dividend growth rate and all important dividend figures tailored to your. Innovator Ibd Breakout Opportunities ETF stocks price quote with latest real-time prices, charts, financials, latest news, technical analysis and opinions. Innovator IBD Breakout Opportunities ETF ETF holdings by MarketWatch. View complete BOUT exchange traded fund holdings for better informed ETF trading. Innovator IBD Breakout Opportunities ETF. BOUT United States. The fund will normally invest at least 80% of its net assets (including investment borrowings). Growth. Fund Owner Firm Name, Innovator ETFs. Prospectus Benchmark Index. IBD Breakout Stocks TR USD, %. Broad Asset Class Benchmark Index. ^SPXTR, A list of holdings for BOUT (Innovator IBD Breakout Opportunities ETF) with details about each stock and its percentage weighting in the ETF. Explore BOUT for FREE on ETF Database: Price, Holdings, Charts, Technicals, Fact Sheet, News, and more. A high-level overview of Innovator IBD® Breakout Opportunities ETF (BOUT) stock. Stay up to date on the latest stock price, chart, news, analysis. Fund Details. Legal Name. Innovator IBD Breakout Opportunities ETF. Fund Family Name. Innovator ETFs Trust. Inception Date. Sep 12, Shares Outstanding. Innovator Ibd Breakout Opportunities Etf share price live: BOUT Live stock price with charts, valuation, financials, price target & latest insights. BOUT tracks an index of US-listed stocks that are likely to breakout, as determined by technical analysis. Holdings are weighted by a mix of fundamental and. View the latest Innovator IBD Breakout Opportunities ETF (BOUT) stock price and news, and other vital information for better exchange traded fund investing. Explore the latest news, in-depth analysis, performance evaluation, and Q&A for Innovator IBD Breakout Opportunities ETF (BOUT). Gain valuable insights from. Innovator ETFs Trust - Innovator IBD Breakout Opportunities ETF's top holdings are Oscar Health, Inc. (US:OSCR), PROCEPT BioRobotics Corporation (US:PRCT). The investment seeks to track, before fees and expenses, the performance of the IBD® Breakout Stocks Index (the "index"). The fund normally invests at least.

How Stripe Payment Works

Stripe's Payments API makes it easy to support multiple payment methods through a single integration. This leaves you with a unified and elegant integration. Stripe is best for online credit card processing and works with Visa, Mastercard, Discover, and American Express. It's a scalable platform that's easy to. The Stripe payment gateway allows individuals and businesses to accept payments over the internet. Stripe believes that payment is a problem rooted in code, not. After your purchaser clicks on the “Pay (total amount)” button, Stripe validates all payment details and either displays an error message or makes a. Once you've set up your Stripe account, you can enable Stripe as a payment method in your Found invoices and receive contactless card payments using your Found. Learn how to take online payments using Anvil and Stripe. Note: This guide includes screenshots of the Classic Editor. Saved payment method details can continue to work even if the issuing bank replaces the physical card. Stripe works with card networks and automatically. Stripe is a payment processing platform that collects payments by credit or debit card and pays them into the merchant's Stripe account, less credit card. Accept payments in person using Stripe Terminal. Developer-friendly SDKs let you create a custom checkout that brings Stripe's payments platform to your in-. Stripe's Payments API makes it easy to support multiple payment methods through a single integration. This leaves you with a unified and elegant integration. Stripe is best for online credit card processing and works with Visa, Mastercard, Discover, and American Express. It's a scalable platform that's easy to. The Stripe payment gateway allows individuals and businesses to accept payments over the internet. Stripe believes that payment is a problem rooted in code, not. After your purchaser clicks on the “Pay (total amount)” button, Stripe validates all payment details and either displays an error message or makes a. Once you've set up your Stripe account, you can enable Stripe as a payment method in your Found invoices and receive contactless card payments using your Found. Learn how to take online payments using Anvil and Stripe. Note: This guide includes screenshots of the Classic Editor. Saved payment method details can continue to work even if the issuing bank replaces the physical card. Stripe works with card networks and automatically. Stripe is a payment processing platform that collects payments by credit or debit card and pays them into the merchant's Stripe account, less credit card. Accept payments in person using Stripe Terminal. Developer-friendly SDKs let you create a custom checkout that brings Stripe's payments platform to your in-.

Stripe is an international system that allows people and businesses to make or receive payments online. Stripe serves as a mediator between buyers and sellers. Stripe Payment Flow · Customer clicks 'Pay'. · A payment is charged to the Customer's Card on file for the Milestone Value + any Tax + the Admin Fee. · Within. Connect Stripe as a payment provider to accept card payments from your customers. Using Stripe, you can also set up recurring payments for repeating services. Amazon Pay and Stripe help businesses of all sizes grow internet commerce through frictionless customer checkout experiences and innovative payment options. Stripe is a payment gateway that allows people and businesses to take payments online. No coding or technical experience is needed. Find a Stripe partner with the solution or services you need. Work with experts that specialize in solving your business problems. Stripe is a payment processing platform that can be integrated with hundreds of e-commerce platforms, shopping carts, and other third-party applications. About This Feature · Stripe Supported Countries · Third-Party Payment Gateway Fee · How it Works · Connecting Your Stripe Account · Confirming Account Setup in. Stripe is an online payment system that allows you to accept payments from your customers without having to set up a merchant account. Does Stripe work internationally? Yes, but payment methods can vary from country to country. Here are some examples of multiparty payments. ACN Credit Transfer. With Subscriptions, customers make recurring payments for access to a product. Subscriptions require you to retain more information about your customers. Stripe's Dashboard and API make it easy to get paid once a transaction has been settled. You can get unified payouts across all the payment methods and. How Does Stripe Work? Stripe's platform allows one to accept and process payments as well as manage finance online. This is one of the most popular eCommerce. Stripe Payment Gateway module is PCI compliant payments system and will work in live and in debugging mode. Connect a Stripe account to your mobile device and get started charging customers in less than 30 seconds. No monthly fees. No minimums. Increase conversion with built-in optimizations, access to + payment methods, and one-click checkout. Unify online and in-person payments to provide a. Stripe allows you to accept credit and debit card payments, set up recurring subscriptions, and use the Buy Now Pay Later business model. Provide seamless online credit card and ACH payments for customers. Collect your payments dynamically by scheduling recurring payments, syncing standalone. How Stripe works Stripe is recommended for those who want to pay bills repeatedly and send or receive payments along with setting up a business. If we look. Stripe powers online and in-person payment processing and financial solutions for businesses of all sizes. Accept payments, send payouts, and automate.

Near Token

The NEAR token's main function is for paying transaction fees or for being used as collateral when storing data on the blockchain. Various groups of NEAR. NEAR tokens act as the backbone of the NEAR Protocol. They are the primary currency within the ecosystem, playing a pivotal role in its function and security. The price of NEAR Protocol (NEAR) is $ today with a hour trading volume of $,, This represents a % price increase in. Guaranteed asset security. Weekly payments. You do not need to purchase a platform token to access higher rates; Composed; No blocking of funds. Company to Offer Secure Custody Solutions to NEAR Token Holders and NEAR Foundation. PALO ALTO, CA — July 19, — BitGo, the leader in digital asset. The NEAR blockchain was created and developed by the NEAR Foundation. Its mainnet went live in April , and network validators voted to unlock token. NEAR Protocol is a Layer 1 blockchain for developers to create and launch their own decentralized applications (dApps) serving a wide range of use cases. Gain detailed information about Near Protocol (NEAR) unlock and vesting. Use our token unlock calendar for planning and optimizing your investments. NEAR Protocol, often called NEAR, is a robust layer one blockchain network designed to optimize performance through a proof of stake consensus mechanism and. The NEAR token's main function is for paying transaction fees or for being used as collateral when storing data on the blockchain. Various groups of NEAR. NEAR tokens act as the backbone of the NEAR Protocol. They are the primary currency within the ecosystem, playing a pivotal role in its function and security. The price of NEAR Protocol (NEAR) is $ today with a hour trading volume of $,, This represents a % price increase in. Guaranteed asset security. Weekly payments. You do not need to purchase a platform token to access higher rates; Composed; No blocking of funds. Company to Offer Secure Custody Solutions to NEAR Token Holders and NEAR Foundation. PALO ALTO, CA — July 19, — BitGo, the leader in digital asset. The NEAR blockchain was created and developed by the NEAR Foundation. Its mainnet went live in April , and network validators voted to unlock token. NEAR Protocol is a Layer 1 blockchain for developers to create and launch their own decentralized applications (dApps) serving a wide range of use cases. Gain detailed information about Near Protocol (NEAR) unlock and vesting. Use our token unlock calendar for planning and optimizing your investments. NEAR Protocol, often called NEAR, is a robust layer one blockchain network designed to optimize performance through a proof of stake consensus mechanism and.

BscScan allows you to explore and search the Binance blockchain for transactions, addresses, tokens, prices and other activities taking place on BNB Smart. PolygonScan allows you to explore and search the Polygon blockchain for transactions, addresses, tokens, prices and other activities taking place on Polygon. I an new to OpenModelica and I am just trying to solve 3 basic simultaneous equations. But it gives me the error as "No viable alternative near token: =". The NEAR Token Hub is an educational resource provided to ecosystem members free of charge, through collaboration with the professionals at Economics Design. NEAR is the native token of the NEAR Protocol, a highly scalable blockchain network that provides a developer-friendly, decentralized application platform. How to get up to % in crypto rewards on your NEAR purchases? To earn crypto rewards, make sure the ratio of NEXO Tokens in your account against the rest of. NEAR Protocol is a smart contract capable, public Proof-of-Stake (PoS) blockchain that was conceptualized as a community-run cloud computing platform. NEAR Blocks is the leading blockchain explorer dedicated to the NEAR ecosystem. Powered by NEAR Protocol. NearBlocks is operated full and on its own. Stay updated with the latest NEAR Protocol token price, charts, and market trends. Dive deep into comprehensive cryptocurrency news and insights on our. NEAR is valuable for a few reasons. Mainly, it's used for the network's governance. Users are able to stake their NEAR tokens and vote for the delegators who. Measure and evaluate Blockchains and Dapps through traditional financial metrics. Token Terminal is a Crypto Analytics Platform with Advanced Metrics. NEAR Protocol is a decentralized application platform designed to make apps usable on the web. The network runs on a Proof-of-Stake (PoS) consensus mechanism. NEAR (NEAR) Token Tracker on Etherscan shows the price of the Token $, total supply , number of holders and updated. NEAR is also used as collateral for storing data on the NEAR Protocol blockchain. NEAR price information is available on Binance. How Do Network Consensus and. Near Blocks is a Block Explorer and Analytics Platform for Near blockchain (N), a new blockchain and smart transaction platform. Near Protocol have raised a total of $ M in 14 completed rounds: Private, Private and 12 more At the moment Market Cap is $ B, NEAR Token Price. NEAR also has its own consensus mechanism, called Doomslug. What is NEAR Protocol used for? NEAR, the native token of the NEAR Platform, is mainly used by. Guaranteed asset security. Weekly payments. You do not need to purchase a platform token to access higher rates; Composed; No blocking of funds. a small crate to work with NEAR token values ergonomically and efficiently - GitHub - near/near-token-rs: a small crate to work with NEAR token values. NEAR is the native cryptocurrency of Near Protocol, used for transaction fees, storage, and staking by validators to maintain network consensus.

How Do I Get A Broker

Get an undergraduate degree in finance or a related field. While some states don't have educational requirements to become a broker, many brokerage firms are. BrokerCheck is a trusted tool that shows you employment history, certifications, licenses, and any violations for brokers and investment advisors. Become a Real Estate Broker · Requirements · Course Providers, Course Curriculum and Course Applications · Real Estate Branch Office Application · LEARN MORE. To start, Complete hours of approved pre-licensing education. Successfully complete clock hours of approved Pre-Licensing Affiliate Broker courses. Find the Best North Carolina Real Estate Broker-in-Charge to Work For · Key Takeaways · Find a local broker-in-charge or company · Weigh the interior and. You'll have to complete eight college-level broker courses before you can apply to take the broker exam. Easily use and manage your brokerage account with Schwab support. Checkmark Icon Buy and sell Trade stocks, options, bonds, mutual funds, ETFs, and other. 1. Commission split 2. Internet presence 3. Fees 4. Brokerage size 5. Facilities 6. Location 7. Training 8. Mentor program 9. Management support In order to qualify for licensure as a Real Estate Broker, an applicant must have at least two years of experience as a licensed real estate salesperson. Get an undergraduate degree in finance or a related field. While some states don't have educational requirements to become a broker, many brokerage firms are. BrokerCheck is a trusted tool that shows you employment history, certifications, licenses, and any violations for brokers and investment advisors. Become a Real Estate Broker · Requirements · Course Providers, Course Curriculum and Course Applications · Real Estate Branch Office Application · LEARN MORE. To start, Complete hours of approved pre-licensing education. Successfully complete clock hours of approved Pre-Licensing Affiliate Broker courses. Find the Best North Carolina Real Estate Broker-in-Charge to Work For · Key Takeaways · Find a local broker-in-charge or company · Weigh the interior and. You'll have to complete eight college-level broker courses before you can apply to take the broker exam. Easily use and manage your brokerage account with Schwab support. Checkmark Icon Buy and sell Trade stocks, options, bonds, mutual funds, ETFs, and other. 1. Commission split 2. Internet presence 3. Fees 4. Brokerage size 5. Facilities 6. Location 7. Training 8. Mentor program 9. Management support In order to qualify for licensure as a Real Estate Broker, an applicant must have at least two years of experience as a licensed real estate salesperson.

Things to look for in a broker. First, don't assume the first broker you call or who shows you a listing is the one for you. Ask yourself. Learn what a Broker is, what they do, and how become one. Step 1. Become a licensed Texas real estate agent. You have to be an active licensed agent for 4 of the last 5 years before you can apply for a broker license. Two broker-owners share some of the biggest lessons they learned opening their respective real estate companies. Things to look for in a broker. First, don't assume the first broker you call or who shows you a listing is the one for you. Ask yourself. It only takes one more hour course to get a Broker license. Consider filling out our Broker Plan of Attack form and then follow the five simple steps. To become a stockbroker, you must first earn a Series 7 license. Known as the General Securities Registered Representative license. 1. Commission split 2. Internet presence 3. Fees 4. Brokerage size 5. Facilities 6. Location 7. Training 8. Mentor program 9. Management support To obtain a California real estate broker license, you must first qualify for and pass a written examination. A brokerage that includes accessible educational resources, an easy-to-navigate app and website, zero commissions, low fees and attainable minimums. First of all, you have to decide whether you want to go with a full-time service broker or a discount broker. If you are looking for a full-time. Follow these four steps to set up a brokerage account. After you decide which brokerage firm is best for you, the next step is to set up your account. Applicants for a real estate broker license examination must have successfully completed the following eight statutorily required college-level courses. Experienced real estate agents must take broker courses and pass a licensing exam and background check to become a broker in Arizona. Depending on their state's requirements, prospective brokers must spend one to three years working as a real estate sales agent before they can apply for. First of all, you have to decide whether you want to go with a full-time service broker or a discount broker. If you are looking for a full-time. Brokers A typical broker accepts and carries out orders to buy and sell investments. It also may make recommendations to buy, sell or hold a specific. Learn what you need to know when selecting the right real estate brokerage. Whether starting your career or you moving to a new broker, learn how to make an. In order to qualify for licensure as a Real Estate Broker, an applicant must have at least two years of experience as a licensed real estate salesperson. In this article, we will outline the five steps you need to take when starting your own brokerage to give you a competitive edge.