zomerstorm.online Community

Community

Stock Ticker Symbols

Stock symbols, or tickers, are a unique series of letters assigned to a public company for trading purposes. Some stock exchanges have up to 3 numbers and. Real-time trading information, real-time stock price index, delayed trading information, after-market information and historical trading information. Ticker symbols also exist for other securities, such as exchange-traded funds (ETFs). Some popular ticker symbols are GOOGL for Google, AMZN for Amazon, MSFT. Research stocks, ETFs, REITs and more. Get the latest stock quotes, stock charts, ETF quotes and ETF charts, as well as the latest investing news. An overview of all the stock ticker symbols listed. Explore the stock pages to learn about the company's price history, financials, key stats, and more. Which Companies have a Single Letter Stock Ticker Symbols? ; S · Sprint Nextel Corp (formerly Sears, Roebuck & Company) ; T · AT&T Inc, from merger of SBC and old. A Ticker is a symbol, a unique combination of letters and numbers that represent a particular stock or security listed on an exchange. The most common type of stock symbol is the stock or equity symbol. Stocks listed and traded on the US markets bear stock symbols with a maximum of four letters. A comprehensive list of all stock tickers we cover on our site. From financials to energy to industrials, we have a diverse selection of stocks to choose from. Stock symbols, or tickers, are a unique series of letters assigned to a public company for trading purposes. Some stock exchanges have up to 3 numbers and. Real-time trading information, real-time stock price index, delayed trading information, after-market information and historical trading information. Ticker symbols also exist for other securities, such as exchange-traded funds (ETFs). Some popular ticker symbols are GOOGL for Google, AMZN for Amazon, MSFT. Research stocks, ETFs, REITs and more. Get the latest stock quotes, stock charts, ETF quotes and ETF charts, as well as the latest investing news. An overview of all the stock ticker symbols listed. Explore the stock pages to learn about the company's price history, financials, key stats, and more. Which Companies have a Single Letter Stock Ticker Symbols? ; S · Sprint Nextel Corp (formerly Sears, Roebuck & Company) ; T · AT&T Inc, from merger of SBC and old. A Ticker is a symbol, a unique combination of letters and numbers that represent a particular stock or security listed on an exchange. The most common type of stock symbol is the stock or equity symbol. Stocks listed and traded on the US markets bear stock symbols with a maximum of four letters. A comprehensive list of all stock tickers we cover on our site. From financials to energy to industrials, we have a diverse selection of stocks to choose from.

Track ticker changes with a sortable list of stock symbol changes that includes the old symbol, new symbol, and the date of the symbol change. Download a list of all companies on New York Stock Exchange including symbol and name. The Company's ticker symbol on the Frankfurt Stock Exchange remains "FMV". No action is required by First Majestic's shareholders in connection with this. the stock symbols FWONA and FWONK, respectively. The Series B Liberty Formula One common stock is quoted on the OTC Markets under the symbol FWONB. The. Name. Symbol. Market Value (millions). Exxon Mobil Corporation. XOM. $, General Electric Company. GE. $, Microsoft Corporation. What Is a Ticker Symbol? A ticker symbol is a stock symbol; an abbreviation of a company's name that uniquely identifies its publicly traded shares on stock. This is the Ticker Symbol of the security, an easily memorable identifier used to trade the security on the stock exchange. A stock symbol is a unique series of letters or numbers used to identify a stock traded on a stock exchange. Also known as stock tickers or ticker symbols. The NYSE preferred ticker symbol format often used to refer to preferred and income securities is the xxxPRx, xxPRx, xPRx, xxPR, etc. format where the x's. Our stock is listed and traded on the New York Stock Exchange under the ticker symbol KO. The Coca Cola Company Logo. A “Ticker Symbol” is a unique one to five letter code used by the stock exchanges to identify a company. Stock ticker is a shorthand symbol used to identify a specific publicly traded company's stock on a stock exchange. The My Symbols watchlist contains your complete library of ticker symbols; the watchlists you create contain just the ticker symbols you add to them. Symbol. Name. A, AGILENT TECHNOLOGIES INC. AA, ALCOA CORPORATION. AACG, ATA The New York Stock Exchange operates five equities exchanges, each purpose. Stock symbols, or ticker symbols, are unique combinations of letters assigned to a publicly traded company's stock. They are used to identify stocks in the. Symbol, Name, Last Sale, Net Change, % Change, Market Cap. AAPL · Apple Inc. Common Stock, $, , %, 3,,,, Stocks on the NYSE use character ticker symbols. For example: General Motors is 'GM', AT&T is 'T', IBM is 'IBM'. You can enter the symbol in upper or lower. Type some text in cells. For example, type a ticker symbol, company name, or fund name into each cell. Then select the cells. Although. Search ,+ stock ticker symbols from 70 exchanges supported by the marketstack stock market data REST API service. ; GOOGL, Alphabet Inc - Class A, NASDAQ. Each exchange has three file types: exchange_full_zomerstorm.online This is the raw data from NASDAQ list. It is not a simple list of ticker symbols and contains.

How Do You Pay Off Credit Card Debt Quickly

Balance transfer cards are a great way to save money while paying off your debt, since you don't accrue additional interest during the intro period. Just note. How to pay off credit card debt · 1. Get the full picture · 2. Calculate your budget for credit card debt repayment · 3. Prioritize your highest-interest debt · 4. Pay off debt faster by refinancing or consolidating to a shorter-term loan or refinance to a lower rate. Contact Wells Fargo to learn about your options. Credit card debt is easy to accrue and sometimes much harder to get rid of. But with some planning and focus, you can pay it down and become credit card-debt-. Another option for the best way to pay off credit card debt is to consolidate several balances into one account with a lower rate. This strategy simplifies your. When you take out a debt consolidation loan, you use the proceeds to pay off all your credit card debt. Then, instead of making payments to several creditors. Go to a good local credit union. (I've also heard fidelity can be helpful). Ask them for help consolidating and paying down your credit cards. Step 1: Face credit card debt head-on · Gather the monthly statements from all your credit cards. · Write down the interest rate, payment due date, missed payment. This calculator will give you monthly payment plans for up to 8 credit cards or loans. Balance transfer cards are a great way to save money while paying off your debt, since you don't accrue additional interest during the intro period. Just note. How to pay off credit card debt · 1. Get the full picture · 2. Calculate your budget for credit card debt repayment · 3. Prioritize your highest-interest debt · 4. Pay off debt faster by refinancing or consolidating to a shorter-term loan or refinance to a lower rate. Contact Wells Fargo to learn about your options. Credit card debt is easy to accrue and sometimes much harder to get rid of. But with some planning and focus, you can pay it down and become credit card-debt-. Another option for the best way to pay off credit card debt is to consolidate several balances into one account with a lower rate. This strategy simplifies your. When you take out a debt consolidation loan, you use the proceeds to pay off all your credit card debt. Then, instead of making payments to several creditors. Go to a good local credit union. (I've also heard fidelity can be helpful). Ask them for help consolidating and paying down your credit cards. Step 1: Face credit card debt head-on · Gather the monthly statements from all your credit cards. · Write down the interest rate, payment due date, missed payment. This calculator will give you monthly payment plans for up to 8 credit cards or loans.

Ways to Pay Off Credit Card Debt. What to Know. Credit cards are a convenient way to make both large and small purchases. They can also lead to a significant. Moving the debt to a card with low or 0% interest could help you pay off the debt faster. Remember: Low or 0% interest credit cards are hard to get if you do. Limit credit card use. · Use a card with no balance for normal purchases. · Open a Huntington Checking Account · Budget more for paying off debt. · Make extra. 3. Choose a Credit Card Payment Strategy · Debt Snowball: This involves paying off the card with the lowest interest rate first. · Debt Avalanche: This is the. Trying to eliminate all of your debt? Keeping credit accounts open, and paying the balances in full every month, may help you maintain or increase your credit. There are two methods when it comes to paying off your credit card debt: the avalanche method or the snowball method. To pay off $5, in credit card debt within 36 months, you will need to pay $ per month, assuming an APR of 18%. You would incur $1, in interest charges. With the debt avalanche method, you prioritize paying off the credit card with the highest annual percentage rate first. Once that balance is paid off, you. How to Pay Off Credit Cards Faster: Use These 11 Strategies · 1. Stop Using Your Cards! · 2. See if You Can Cut Your Credit Card Interest Rate by 70% · 3. Use a. The next step is to create a payoff plan. This should outline how much you can realistically pay toward your credit card debt each month, and how long it'll. Pay off high-interest debts first. Using a strategy called the debt avalanche method, you make the minimum payments on all your debts and put extra money toward. For those who qualify, using a balance transfer card is the most active approach to paying off your credit card debt because it involves moving your debt to a. The Easiest Way to Pay Off Credit Card Debt · Create a credit card repayment plan · Stop adding to your debt · Follow the debt snowball method · Follow the debt. A good debt consolidation loan will pay off your credit cards all at once, rearranging your finances to pay off the loan at a lower interest rate over a longer. 10 Tips To Pay Off Your Credit Card Faster · 1 - Get Organised · 2 - Identify the Card with the Highest Interest Rate · 3 - Pay the Minimum Balance on All of Your. Stop using your credit cards. If you need help paying off your credit cards, the first step is to completely stop using them. It may be easier said than. Pay as much as you can each month If you can make higher repayments each month, you will pay off the debt faster and save money. Work out the fastest way to. In the snowball method, you start by paying extra on the credit card with the smallest balance until it's paid off. Then move on to the card with the next. If you owe money on your credit cards, the wisest thing you can do is pay off the balance in full as quickly as possible. Virtually no investment will give you. With no emergency savings to draw on during a crisis, you may have to rely on a high-interest credit card or a personal loan to cover the costs. To avoid.

Form 8949 Cryptocurrency

IRS Form CoinLedger generates and auto-fills this required tax form for you to attach to your return. This report includes all of your short term and. You'll likely get cryptocurrency tax preparation questions this year. Watch the webinar for info on tax requirements & form cryptocurrency reporting. Form captures the details of every sale triggering a gain or loss. The details supporting the final calculation, include, but are not limited to, asset. This depends on your individual tax situation and your specific transactions involving bitcoin. If you sold bitcoin you may need to file IRS Form and a. To report crypto losses, you should use Form and Form Schedule D. What if my crypto was stolen or lost? Losing cryptocurrency in one of the. Understanding Form B and CoinList is on a mission to make cryptocurrency taxes as seamless as possible. CoinList provides all users that incurred. If you sold crypto you likely need to file crypto taxes, also known as capital gains or losses. You'll report these on Schedule D and Form if necessary. Crypto taxes , Cryptocurrency tax IRS Form and Schedule D, Crypto gains, and losses. Cryptocurrency Tax consultant www. Crypto Tax Calculator Capital Gains Report should be submitted with your Form if required. Long Term Gains. The name and SSN/TIN you fill in before. IRS Form CoinLedger generates and auto-fills this required tax form for you to attach to your return. This report includes all of your short term and. You'll likely get cryptocurrency tax preparation questions this year. Watch the webinar for info on tax requirements & form cryptocurrency reporting. Form captures the details of every sale triggering a gain or loss. The details supporting the final calculation, include, but are not limited to, asset. This depends on your individual tax situation and your specific transactions involving bitcoin. If you sold bitcoin you may need to file IRS Form and a. To report crypto losses, you should use Form and Form Schedule D. What if my crypto was stolen or lost? Losing cryptocurrency in one of the. Understanding Form B and CoinList is on a mission to make cryptocurrency taxes as seamless as possible. CoinList provides all users that incurred. If you sold crypto you likely need to file crypto taxes, also known as capital gains or losses. You'll report these on Schedule D and Form if necessary. Crypto taxes , Cryptocurrency tax IRS Form and Schedule D, Crypto gains, and losses. Cryptocurrency Tax consultant www. Crypto Tax Calculator Capital Gains Report should be submitted with your Form if required. Long Term Gains. The name and SSN/TIN you fill in before.

Coinpanda makes it easy to generate your Bitcoin and crypto tax reports Free tax forms Download IRS Form and Schedule D instantly. Who needs to file crypto tax Form If you haven't earned any net capital gains from crypto transactions, you are not considered to have any taxable gains. This comprehensive guide will walk you through step-by-step how to properly report your crypto gains and losses on IRS Form Schedule D and Form digital asset transactions on an attached Schedule D. Transactions are itemized on Form where a taxpayer will list each disposition along with a. Form Sales and Other Dispositions of Capital Assets is an Internal Revenue Service (IRS) form used to report capital gains and losses from investments. For as little as $, clients of zomerstorm.online can use the services of Formcom to generate IRS Schedule D and Form Form is a required addition to your annual tax return when you have sold capital assets such as stocks at a profit or a loss during the year. Is your firm ready for accurate Form cryptocurrency reporting for your clients? This whitepaper looks at cryptocurrency tax preparation. For as little as $, clients of Robinhood Crypto can use the services of Formcom to generate IRS Schedule D and Form When preparing taxes, individuals dealing with cryptocurrency transactions may notice discrepancies between their transaction histories in wallets or exchanges. Generate tax Form on a crypto service and then prepare and e-file your taxes on FreeTaxUSA. Premium federal taxes are always free. Key Takeaways · Reporting cryptocurrency on your tax return is mandatory in the U.S., utilizing Form for capital gains and losses, and integrating with. Just got my return back and my accountant listed crypto as a single line item on form , except he checked box C instead of Box A up top. Form captures detail of every sale triggering a gain or loss, with all the details supporting the final calculation. Browser. Before you start:If the transactions were virtual currency or cryptocurrency, you can use this method if the basis was reported to the IRS for the. Use your crypto transaction history from your wallet or exchange to enter your sales. OR; Use a crypto tax service to generate a Form of your crypto. Form is an IRS tax form used to report capital gains and losses from various transactions, such as the sale of stocks, bonds, real estate, and other. All such transactions must be reported on Form and Schedule D. It's crucial to keep detailed records of every trade, including the date, amount, and value. If a taxpayer checks Yes, then the IRS looks to see if Form (which tracks capital gains or losses) has been filed. If the taxpayer fails to report their. You fill out Form with your Schedule D when you have to report extra information from the sale of capital assets such as stocks, bonds, or cryptocurrencies.

Money Advice Radio Show

Beat conventional advice on personal finance, investing, and business with the author of Rich Dad Poor Dad, Robert Kiyosaki. The weekly Money Matters with Ken Moraif podcast is designed for people over the age of 50 who are seeking retirement planning advice. On his show, Ken. Discover the Your Money radio show and podcast with Bruce Helmer and Peg Webb, providing financial education to listeners for over 20 years. ABOUT THE SHOW From America's Matriarch of Money, Suze Orman's Women & Money podcast speaks directly to every mother, daughter, grandmother, sister, and wife. I love this show. I started out listening to Dave Ramsey, but have transitioned mostly over to The Money Guy. I think they have better advice as. In this episode of Wise Money, Michael Andersen explores the art of being savvy with your income during retirement. Join us as we dive into the essential tips. Watch or listen every week to learn and apply financial strategies to grow your wealth and live your best life. Listeners will be provided various viewpoints on how to set themselves up for financial success. If you're looking for get-rich-quick tips and tricks to. Clark hosts The Clark Howard Show, a podcast full of straightforward tips on managing debt, credit, monthly bills, savings, retirement, and more. He likes to. Beat conventional advice on personal finance, investing, and business with the author of Rich Dad Poor Dad, Robert Kiyosaki. The weekly Money Matters with Ken Moraif podcast is designed for people over the age of 50 who are seeking retirement planning advice. On his show, Ken. Discover the Your Money radio show and podcast with Bruce Helmer and Peg Webb, providing financial education to listeners for over 20 years. ABOUT THE SHOW From America's Matriarch of Money, Suze Orman's Women & Money podcast speaks directly to every mother, daughter, grandmother, sister, and wife. I love this show. I started out listening to Dave Ramsey, but have transitioned mostly over to The Money Guy. I think they have better advice as. In this episode of Wise Money, Michael Andersen explores the art of being savvy with your income during retirement. Join us as we dive into the essential tips. Watch or listen every week to learn and apply financial strategies to grow your wealth and live your best life. Listeners will be provided various viewpoints on how to set themselves up for financial success. If you're looking for get-rich-quick tips and tricks to. Clark hosts The Clark Howard Show, a podcast full of straightforward tips on managing debt, credit, monthly bills, savings, retirement, and more. He likes to.

Our mission is to help you save more and spend less. From paying down debt, to making major purchases, to saving for retirement, and every money moment in. Our mission is to help you save more and spend less. From paying down debt, to making major purchases, to saving for retirement, and every money moment in. Planet Money · Money · It's Not About the Money · Money for the Rest of Us · Mad Fientist · Disruptive Entrepreneur · Dave Ramsey · Farnoosh Torabi. The latest news from the world of personal finance plus advice for those trying to make the most of their money. Download this programme. Subscribe to. Listen to or watch The Ramsey Show! Get advice on paying off debt (like credit cards) and building wealth from America's most trusted financial advisor. You can listen to Dave Ramsey on his radio show, “The Dave Ramsey Show.” Every episode focuses on the financial difficulties that real people are going through. So it comes as no surprise that Chelsea's podcast, The Financial Confessions, is all about getting honest about money. On the show, Chelsea sits down to talk to. jill on money radio show. Go to Podcasts. BLOG. From the Blog advice from your own financial or investment adviser. GDPR Marketing Permissions: The Jill on. The Ramsey Show believes you can build wealth and take control of your life—no matter what stupid mistakes you've made with money. Join as Dave Ramsey and his. Host and fiduciary John Hagensen debunks financial industry myths and challenges dated financial advice Our FREE Retirement Review will show you. 1. The Ramsey Show · 2. The Clark Howard Podcast · 3. Women & Money · 4. So Money · 5. BiggerPockets Money · 6. AffordAnything · 7. Money Guy Show · 8. Optimal Finance. The Show · The Money Guy Show: Fresh Financial Advice That Goes Beyond Common Sense · Financial Advisors React to Money Advice from Dave Ramsey · How Much Cash Is. How To Money – KFI Radio Show. My newest venture, a weekly live radio segment on KFI called How To Money, provides down-to-earth financial advice to listeners. Moulton Wealth Management's Your Money Matters Radio Show is a great source of information for individuals and businesses looking for sound financial advice. On today's Faith & Finance Live, Sharon Epps will join host Rob West with some much-needed advice—the 5 Ds of a Financial Reset. Then Rob will tackle your. Tom Cock was the host of the PBS-TV show “Serious Money” for many years, and Don McDonald hosted a nationally syndicated financial talk show since “Dollars and Sense” is Central Florida's longest running radio show with over 1, episodes. The show covers a wide range of topics – from retirement income. David Lawrence Ramsey III (born September 3, ) is an American radio personality who offers financial advice. He hosts the nationally syndicated radio. NPR coverage of personal finance, money, investing, taxes, retirement, mortgages and housing markets, wealth management, and stock market news. Everyday Wealth, a nationally syndicated radio show and podcast hosted by Jean Chatzky, explores important financial decisions and how they affect our lives.

Transfer From Coinbase Pro To Wallet

Tap Transfer. · Tap Send crypto. · Select the asset. · You can select a contact, scan the recipient's QR code, or enter their email, phone number, crypto address. Log into your Coinbase account and navigate to the wallet section. Keep an eye on the transaction status to monitor the progress of your. 1. Log in to your Coinbase Wallet account. · 2. Click the button labeled 'Receive'. · 3. Click on the option 'Add crypto with Coinbase Pay'. · 4. Sign in to your. The answer to this question is yes. You can transfer any amount of your Coinbase portfolio to your Coinbase Pro account whenever you want. Users can easily transfer funds between their regular Coinbase and Coinbase Pro wallets. Coinbase or Coinbase Pro wallet under the 'Destination' option. Then, enter your wallet address and the amount of ETH you want to transfer from Coinbase to your MetaMask wallet. Once you're done, click 'Continue'. Pro Tip. The transfer process can be done through the Coinbase app by selecting "Transfer" and "Send Crypto." After selecting the asset to transfer, you. From the Coinbase Wallet home screen, select Send. You'll be prompted to select the asset you'd like to use and to choose a desired amount. Initiate a transfer on the Portfolios section by selecting Withdraw. · Select All portfolios to transfer all funds, or choose assets individually to transfer. Tap Transfer. · Tap Send crypto. · Select the asset. · You can select a contact, scan the recipient's QR code, or enter their email, phone number, crypto address. Log into your Coinbase account and navigate to the wallet section. Keep an eye on the transaction status to monitor the progress of your. 1. Log in to your Coinbase Wallet account. · 2. Click the button labeled 'Receive'. · 3. Click on the option 'Add crypto with Coinbase Pay'. · 4. Sign in to your. The answer to this question is yes. You can transfer any amount of your Coinbase portfolio to your Coinbase Pro account whenever you want. Users can easily transfer funds between their regular Coinbase and Coinbase Pro wallets. Coinbase or Coinbase Pro wallet under the 'Destination' option. Then, enter your wallet address and the amount of ETH you want to transfer from Coinbase to your MetaMask wallet. Once you're done, click 'Continue'. Pro Tip. The transfer process can be done through the Coinbase app by selecting "Transfer" and "Send Crypto." After selecting the asset to transfer, you. From the Coinbase Wallet home screen, select Send. You'll be prompted to select the asset you'd like to use and to choose a desired amount. Initiate a transfer on the Portfolios section by selecting Withdraw. · Select All portfolios to transfer all funds, or choose assets individually to transfer.

Once your Coinbase wallet has been added, go back to the Add Wallets page and select Coinbase Pro. Create a new API key on Coinbase Pro and enter the api key/. Coinbase is the world's most trusted cryptocurrency exchange to securely buy, sell, trade, store, and stake crypto. We're the only publicly traded crypto. Once you have initiated a valid transaction from your wallet, the deposit How to deposit cryptocurrencies to your Kraken account on Kraken Pro. How to. You can deposit funds into Coinbase Pro the same way you deposit funds into Coinbase (the same wallets are available for each). Debit and credit cards and bank. Open the Wallet app · From the Payments tab, tap Send. · Select the asset and amount you'd like to send · Tap Next. · Enter the exact address, ENS or username of. Well, Coinbase Pro has its own wallet for the temporary storage of users' funds until they transfer their funds to a safe crypto wallet. However, there is no. Sign in to your Coinbase Pro account and click on “Portfolios.” · Click “Withdraw.” · Choose “All Portfolios” to transfer all crypto assets to zomerstorm.online Trading fees are also lower on Coinbase Pro. Coinbase Wallet — A standalone crypto wallet app that lets users self-custody (in other words, the users. You don't need to be a Coinbase user to use the wallet, making it ideal for traders that transfer between various fiat currencies and cryptocurrencies. Kraken. 1. Log in to your Coinbase account and navigate to the "Send/Receive" tab. · 2. Choose the "Send" option, select USDT from the list of. Sign in to your zomerstorm.online account. · Select My Assets. · Select your local currency balance. · Select the Cash out tab and enter the amount you want to cash out. Moreover, you can even link the Coinbase Wallet with your bank accounts by selecting the type of account they want to add in Payment Methods or. 1. Log In to Coinbase Pro: Use your Coinbase credentials to log into Coinbase Pro. 2. Navigate to the 'Portfolios' Page: Click on '. Sign in to Coinbase Prime. · From the portfolio tab, search for the asset. · Click Deposit. · Click Transfer Funds Internally. · Select the portfolio and wallet you. For example, I have Bitcoin in Coinbase Pro I transfer my bitcoin from Coinbase Pro directly to my hardware wallet with bitcoin address. Koinly is show. You can link your zomerstorm.online account and your Coinbase Wallet to transfer crypto between your two accounts. How to send/receive Bitcoin on Coinbase? · Navigate to the Dashboard, and select Pay from the left side of the screen. · Select Send and enter the amount of. Simply visit the dashboard of your zomerstorm.online wallet, find and click the “request” button at the top of the page. · Click the “copy” button next to the. Coinbase Wallet: NFTs & Crypto. Finance. Gemini: Buy Bitcoin & Crypto. Finance. Kraken Pro: Buy & Trade Crypto.

Best Solar System For Home

What type of solar panel is best? · Monocrystalline panels are the most efficient of the crystalline solar panels at % efficiency. · Polycrystalline panels. In monocrystalline panels, there are fewer impurities, so the electrons are less likely to get blocked before leaving as electricity, thus these panels are “. The most efficient residential solar panels available are made by Maxeon and Canadian Solar. They have a maximum efficiency rating of %. Grid-tie solar is the best option if you want to offset your electricity bill and save money over the life of your system. Most grid-tie systems pay for. Buy quality solar kits, solar panels & parts (charge controllers, inverters, mounts & more) for off-grid, grid-tied, home, RV, boat and industrial. Our user-friendly app allows homeowners to effortlessly transition to solar power with home solar panel system. Plus, our hassle-free 0-cost EMI options. We break down the best solar panels for a variety of common priorities -- efficiency, warranty, manufacturer location, and more. Which solar system type is best for you? Find the answer in our handy guide for choosing your solar panel kit. Get the Guide. Custom Systems. The home and. Searching for the best solar panels for your home? Our experts recently reviewed the top 10 options for based on cost and efficiency. What type of solar panel is best? · Monocrystalline panels are the most efficient of the crystalline solar panels at % efficiency. · Polycrystalline panels. In monocrystalline panels, there are fewer impurities, so the electrons are less likely to get blocked before leaving as electricity, thus these panels are “. The most efficient residential solar panels available are made by Maxeon and Canadian Solar. They have a maximum efficiency rating of %. Grid-tie solar is the best option if you want to offset your electricity bill and save money over the life of your system. Most grid-tie systems pay for. Buy quality solar kits, solar panels & parts (charge controllers, inverters, mounts & more) for off-grid, grid-tied, home, RV, boat and industrial. Our user-friendly app allows homeowners to effortlessly transition to solar power with home solar panel system. Plus, our hassle-free 0-cost EMI options. We break down the best solar panels for a variety of common priorities -- efficiency, warranty, manufacturer location, and more. Which solar system type is best for you? Find the answer in our handy guide for choosing your solar panel kit. Get the Guide. Custom Systems. The home and. Searching for the best solar panels for your home? Our experts recently reviewed the top 10 options for based on cost and efficiency.

Vivint solar panels offer high efficiency and long-term reliability making a Vivint Energy system a long-term energy solution. There are a number of steps to follow when planning to power your home with solar energy. After choosing which option is best for you to use solar. Venture Solar is a solar company providing high-efficiency, US-made solar panel installation for homes across the Northeast. Backed by a year warranty. What Type of Solar Inverter is the Best? We're confident that an SMA string inverter, Enphase microinverters, SolarEdge string inverter/optimizers, and SMA. While there's no one-size-fits-all solar solution, here are some resources that can help you figure out what's best for you. Top-quality solar panels, solar shingles & energy storage. In-house certified & licensed solar panel installation. Unbeatable solar warranty & power production. Save hundreds of dollars by setting up your own home solar power system. Learn how to fully design, build, and fit a working solar system – even if you're a. As you can tell, our small home solar panel kits vary widely in terms of what they can power. From small, portable solar panels to six-panel bundles that are. Lead-acid batteries are the first choice for an off-grid solar system installation. Their price and stability make them very dependable and easy to upgrade or. Trinity Solar is our first choice for solar installations. It provides top-notch customer support networks with high-quality solar panel installations. For that reason, we rate the Aiko N-Type ABC White Hole as the best solar panel on the market. We certainly recognize that panels with lower upfront costs may. The right solar panel for each home is different depending on your need, but Qcells, Silfab Solar, and JA Solar are some of the best solar panels of the year. Monocrystalline panels have an overall darker tint to the cells and are typically the more efficient option. Panels with a higher efficiency mean you can. Solar panels work best with strong, durable roofing materials, such as composite or asphalt shingle, concrete tile or standing seam metal. Micro inverter solar panel systems are the number one choice among residential solar installations. Micro inverters are efficient, reasonably priced and easy to. 1. Renewable Energy Source: Solar panels harness energy from the sun, which is a renewable and abundant resource. · 2. Lower Electricity Bills. Look for solar power energy companies that provide custom-designed systems tailored to your specific needs, use high-quality solar panels and inverters. Freedom Solar Power is a #1-rated full-service solar company installing solar panels and backup power systems for homeowners and businesses since Monocrystalline solar panels are the most common and efficient type of solar panel available. Due to the silicon's high purity, these panels excel at producing. Tax incentives and flexible financing options ensure you get the best price for your solar system. Sustainable Energy. Power your home with emissions-free.

Is It A Good Idea To Withdraw From Your 401k

:max_bytes(150000):strip_icc()/dotdash_Final_4_Reasons_to_Borrow_From_Your_401k_Apr_2020-011-476fff8e835242c39a99ce76c52e8764.jpg)

Even if you're eligible to withdraw money penalty-free from your (k) or other qualified retirement plan early, consider it carefully. Just because you can. Hardship withdrawals are generally subject to federal (and possibly state) income tax. A 10% federal penalty tax may also apply if you're under age 59½. [If you. The only exception when it would make sense to withdraw early from your (k) during this penalty-free period would be if you absolutely needed the funds for. As if that wouldn't be bad enough—you only have 60 days from the time of a withdrawal to put the money back into a tax-advantaged account like a (k) or IRA. While cashing out is certainly tempting, it's almost never a good idea. Taking a lump sum distribution from your (k) can significantly reduce your. If your account balance is at least $5,, you generally can leave your money in your (k) after retirement. This may be a good idea if you like the plan's. The IRS levies a 10% penalty on all non-exempt withdrawals before the age of 59 ½. · Since pre-taxed money funded your k account, your withdrawal is taxed. Taking a K Loan Might Not Be Such A Good Idea A K is supposed to help you have money in retirement. When you temporarily take money out of the plan, it. But taking money out of your retirement savings account early, no matter the circumstance, could be a costly mistake. There are no penalty exemptions for the. Even if you're eligible to withdraw money penalty-free from your (k) or other qualified retirement plan early, consider it carefully. Just because you can. Hardship withdrawals are generally subject to federal (and possibly state) income tax. A 10% federal penalty tax may also apply if you're under age 59½. [If you. The only exception when it would make sense to withdraw early from your (k) during this penalty-free period would be if you absolutely needed the funds for. As if that wouldn't be bad enough—you only have 60 days from the time of a withdrawal to put the money back into a tax-advantaged account like a (k) or IRA. While cashing out is certainly tempting, it's almost never a good idea. Taking a lump sum distribution from your (k) can significantly reduce your. If your account balance is at least $5,, you generally can leave your money in your (k) after retirement. This may be a good idea if you like the plan's. The IRS levies a 10% penalty on all non-exempt withdrawals before the age of 59 ½. · Since pre-taxed money funded your k account, your withdrawal is taxed. Taking a K Loan Might Not Be Such A Good Idea A K is supposed to help you have money in retirement. When you temporarily take money out of the plan, it. But taking money out of your retirement savings account early, no matter the circumstance, could be a costly mistake. There are no penalty exemptions for the.

Ideally, yes. But it's your money, so the decision of what to do with is ultimately yours. During financially challenging times, it's easy to understand the. While taking money out of your (k) plan is possible, it can impact your savings progress and long-term retirement goals so it's important to carefully weigh. When you need cash to pay bills or make a major purchase, it can be tempting to turn to your retirement account. But taking an early withdrawal or loan. The high cost of hardship withdrawals So what's the best way to have money for unexpected expenses? Build an emergency fund. You can tap into that without. Avoid tax penalties when using your (k) before retirement by taking a hardship distribution or a loan from your plan. Plus: learn ways to minimize the. When you're in need of financing, it may seem like withdrawing from your workplace retirement plan is a viable option. After all, your retirement savings. Once you receive the withdrawal, you'll owe income tax on any pretax money you withdraw, including your own contributions, your employer's contributions and. This is because when you borrow from your retirement account, you're taking away the potential for that money to keep growing over time — especially if you. The cash you withdraw is considered income, and you may incur local, state and federal taxes by doing so. You will lose the benefit of giving your account's. In general, you must pay a 10% penalty on the amount of your withdrawal if you are not at least years old. You'll pay this when you file your taxes and. You may be eligible to borrow money from your retirement savings account by taking a Plan Loan. Depending on your Plan's Document, participants may withdraw up. Many (k) plans allow you to withdraw money before you actually retire for For example, some (k) plans may allow a hardship distribution to pay for your. If your account balance is at least $5,, you generally can leave your money in your (k) after retirement. This may be a good idea if you like the plan's. Many borrowers use money from their (k) to pay off credit cards, car loans and other high-interest consumer loans. On paper, this is a good decision. The Generally, if you withdraw funds from your (k), the money will be taxed at your ordinary income tax rate, and you'll also be assessed a 10 percent penalty if. Plus, annual contribution limits can make it difficult to catch up later on in your career if you withdraw a big chunk of your retirement savings early. While cashing out is certainly tempting, it's almost never a good idea. Taking a lump sum distribution from your (k) can significantly reduce your. Your savings have the potential for growth that is tax-deferred, you'll pay no taxes until you start making withdrawals, and you'll retain the right to roll. Retirement withdrawal strategies Whether you're invested in an IRA, a (k) or another type of plan, you can establish a strategy for withdrawal designed to. In general, it is not advisable to withdraw money early from your K. Some of our clients ask us if they should take an early distribution from their K.

List Of All Stable Coins

1 Tether (USDT). $b ; 2 USD Coin (USDC). $b ; 3 Dai (DAI). $b ; 4 Ethena USDe (USDe). $b ; 5 First Digital USD (FDUSD). $b. Reserve-backed stablecoins · Fiat-backed · Commodity-backed · Cryptocurrency-backed. Stablecoins · Tether USDT · USD Coin USDC · Dai DAI · PayPal USD PYUSD · USDD USDD · Tether Gold XAUt · TrueUSD TUSD · JUST JST. Stablecoins Overview ; sUSD · % ; Neutrino USD · % ; Vai · % ; JUST Stablecoin · % ; Binance USD · %. Our platform supports popular stablecoins such as USDT (Tether), USDC, and DAI, along with other major cryptocurrencies like BTC, ETH, XRP, etc. Whether you are. Stablecoin What it Is? The main criticism, or rather concerns about all cryptocurrencies and their format in general – is firstly, the insane volatility. Top Stablecoins Coins Today By Market Cap ; 1. Tether. . USDT.) $ ; 2. USDC. . USDC.) $ ; 3. Dai. . DAI.) $ ; 4. First Digital USD. . FDUSD.). Stablecoins are cryptocurrencies whose value is pegged, or tied, to that of another currency, commodity, or financial instrument. The top 5 stable coins in may vary depending on market conditions, but some of the most popular ones currently include Tether (USDT), USD Coin (USDC). 1 Tether (USDT). $b ; 2 USD Coin (USDC). $b ; 3 Dai (DAI). $b ; 4 Ethena USDe (USDe). $b ; 5 First Digital USD (FDUSD). $b. Reserve-backed stablecoins · Fiat-backed · Commodity-backed · Cryptocurrency-backed. Stablecoins · Tether USDT · USD Coin USDC · Dai DAI · PayPal USD PYUSD · USDD USDD · Tether Gold XAUt · TrueUSD TUSD · JUST JST. Stablecoins Overview ; sUSD · % ; Neutrino USD · % ; Vai · % ; JUST Stablecoin · % ; Binance USD · %. Our platform supports popular stablecoins such as USDT (Tether), USDC, and DAI, along with other major cryptocurrencies like BTC, ETH, XRP, etc. Whether you are. Stablecoin What it Is? The main criticism, or rather concerns about all cryptocurrencies and their format in general – is firstly, the insane volatility. Top Stablecoins Coins Today By Market Cap ; 1. Tether. . USDT.) $ ; 2. USDC. . USDC.) $ ; 3. Dai. . DAI.) $ ; 4. First Digital USD. . FDUSD.). Stablecoins are cryptocurrencies whose value is pegged, or tied, to that of another currency, commodity, or financial instrument. The top 5 stable coins in may vary depending on market conditions, but some of the most popular ones currently include Tether (USDT), USD Coin (USDC).

Stablecoins are cryptocurrencies that attempt to peg their market value to some external reference. List of Partners (vendors). I Accept Reject All Show. sUSD (Synthetix USD): Part of the Synthetix platform, it's a synthetic asset pegged to the US Dollar. - Algorithmic stablecoins: These aren't backed by any. Today's Algorithmic Stablecoins Coins Prices ; U · USDX [Kava]. USDX. $ $ %. % ; C · Celo Dollar. CUSD. $ $ +%. +. Our platform supports popular stablecoins such as USDT (Tether), USDC, and DAI, along with other major cryptocurrencies like BTC, ETH, XRP, etc. Whether you are. Discover top Stablecoins and view today's prices, market cap, 24h volume, charts, and more info. Stablecoins are “minted” or created by asset issuers. There are many asset issuers who have tokenized global fiat currencies on the Stellar network. Which stablecoins does Kraken support? Today's Stablecoin Coins Prices ; USDP. Pax Dollar. USDP ; USTC. TerraClassicUSD. USTC ; GUSD. Gemini Dollar. GUSD ; USDX [Kava]. USDX. Retrieves total circulating supply for supported stablecoins across all chains. This endpoint is rate limited to one call per minute (based on IP). Assets that have a similar market cap to Stablecoin include PAW PATROL INU, CheckerChain, MCFinance, and many others. To see a full list, see our comparable. Stablecoins · Ampleforth · Augmint · DAI · DefiDollar · EOSDT · Frax · Gemini Dollar · HUSD. The largest stablecoins in the sector, Tether (USDT) and USD Coin (USDC), are both examples of fiat-pegged stable coins. Generally speaking, fiat-pegged digital. The main types of stablecoins are fiat-collateralized and crypto-collateralized, while algorithmically managed and commodity-collateralized stablecoins are also. Top Stablecoins Coins & Tokens by Market Cap ; Tether (USDT). USDTTether. $ +%. Trade ; USDCoin (USDC). USDCUSDCoin. $ +%. Trade ; Dai (DAI). Ethereum, 20, Tether USD (USDT) ; Ethereum, 20, Dai Stablecoin (DAI) ; Ethereum, 20, USD Coin (USDC) ; Ethereum, 20, Binance USD (BUSD). Which are the market's largest stable coins? · Tether (USDT): Tether is not only the world's largest stablecoin but also the world's first. · Binance USD (BUSD). There are several different types of stablecoins, each with its own unique features and characteristics. The most prominent are collateralized, decentralized. Stablecoins ; 1, Tether USDTTether ; 2, USD Coin USDCUSD Coin ; 3, Edelcoin EDLCEdelcoin ; 4, First Digital USD FDUSDFirst Digital USD. Then, use these stablecoins to trade for any trending coin in the market. ** Cookie List. Clear. checkbox label label. Apply Cancel. Consent zomerstorm.onlinest. Main / Blog / Ranking the Best Stablecoins of TOP Revealed. Most popular stablecoins are Tether, USD Coin, Binance USD. 11 min.

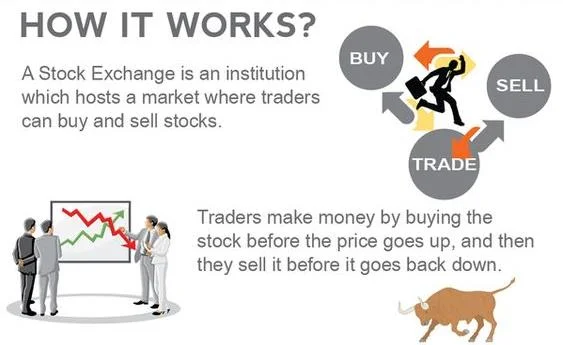

How Does The Stockmarket Work

It set rules for how stocks could be traded and established set commissions. The Agreement aimed to promote public confidence in the markets and to ensure that. If you would like to learn more about NYSE proprietary market insights You work too hard to list anywhere else. Why list on the nyse? happens. Stocks are a type of security that gives stockholders a share of ownership in a company. Companies sell shares typically to gain additional money to grow the. The Company issues and allots shares to some or all investors who bid during the IPO. The shares are then listed on the stock market (secondary market) to. Stocks are bought and sold on a stock exchange such as the New York Stock Exchange (NYSE) and in the private market, where individual and institutional. Stocks are purchased and sold on stock exchanges, which act as the intermediary between investors and companies. Stock exchanges facilitate transactions through. What is the stock market? The stock market does not refer to one specific place, but to several marketplaces or exchanges where stocks and other investments are. Once a stock has been issued in the primary market, all trading in the stock thereafter occurs through the stock exchanges in what is known as the secondary. Primary market: Financial assets are created. In this market, assets are transmitted directly by their issuer. · Secondary market: Only existing financial. It set rules for how stocks could be traded and established set commissions. The Agreement aimed to promote public confidence in the markets and to ensure that. If you would like to learn more about NYSE proprietary market insights You work too hard to list anywhere else. Why list on the nyse? happens. Stocks are a type of security that gives stockholders a share of ownership in a company. Companies sell shares typically to gain additional money to grow the. The Company issues and allots shares to some or all investors who bid during the IPO. The shares are then listed on the stock market (secondary market) to. Stocks are bought and sold on a stock exchange such as the New York Stock Exchange (NYSE) and in the private market, where individual and institutional. Stocks are purchased and sold on stock exchanges, which act as the intermediary between investors and companies. Stock exchanges facilitate transactions through. What is the stock market? The stock market does not refer to one specific place, but to several marketplaces or exchanges where stocks and other investments are. Once a stock has been issued in the primary market, all trading in the stock thereafter occurs through the stock exchanges in what is known as the secondary. Primary market: Financial assets are created. In this market, assets are transmitted directly by their issuer. · Secondary market: Only existing financial.

The stock market is where shares are bought and sold. It's the marketplace within which the 'merchandise' of company stocks is exchanged between parties. In reality, the stock market works like an auction: Sellers decide what price they'll accept, buyers decide what they'll pay. Stockbrokers—or computers—call out. The Dow and S&P include stocks from both the New York Stock Exchange (NYSE). The Nasdaq Composite Index only includes stocks that trade on the Nasdaq Stock. How Market Swings Affect Investments One of the most important things to know about the stock market is that it moves in cycles and is affected by volatility. Definition: The stock market is where buyers and sellers come together to trade shares in eligible companies. The stock market functions in a classic supply and demand economic model. When supply is high because everyone is selling, the price of a stock goes down. When. A stock exchange, securities exchange, or bourse is an exchange where stockbrokers and traders can buy and sell securities, such as shares of stock. How a Stock Exchange Works A number of companies belong to each stock exchange. The companies sell securities to people. People then use the exchange to trade. IPOs and how stocks trade Most U.S.-based stocks trade on exchanges, such as the Nasdaq or the New York Stock Exchange (NYSE), which provide centralized. A stock exchange, securities exchange, or bourse is an exchange where stockbrokers and traders can buy and sell securities, such as shares of stock. Let's take a closer look at what you need to know about how stocks are traded. Think of the stock market as a kind of matchmaker. Each day it's open, it pairs stock sellers with interested buyers. Sellers can be companies offering their. The stock market is the collection of physical and electronic markets where buyers and sellers come together to trade shares. Most (though not all) of the. The first modern stock trading market was created in Amsterdam when the Dutch East India Company was the first publicly traded company. To raise capital, the. Publicly traded stock prices continuously fluctuate based on changes in marketplace supply and demand. If there are more buyers for a certain stock than sellers. The stock market works by allowing buyers and sellers to trade stocks listed on a particular exchange, mostly online and through licensed brokers. Stocks represent partial ownership of a company. Depending on the stock type, they may also grant shareholders the right to vote on certain decisions affecting. We've compiled a one-stop shop for learning the basics of how the stock market works. From what the market actually is to how to buy stocks and shares, we've. The stock market is a marketplace where people buy and sell shares, or stock, in companies based on how much they think they will be worth in the future. The stock market is where investors connect to buy and sell investmentsmost commonly, stocks, which are shares of ownership in public companies. People will.

Can You Claim Home Equity Loan On Taxes

:strip_icc()/home-equity-loan-tax-deduction-3155014-e80945d7d6d74f0590138363f188d23b.png)

When deducting interest paid on a home equity loan or HELOC, be sure to keep all receipts and invoices for labor and materials. You'll need them in case you. Home equity loan interest can be tax deductible if your mortgage debt is under the government maximum and you use the funds for significant home. For a home equity loan, you can deduct the interest on up to $, of the loan for married filers, or $, for couples who are married filing separately. Interest on home equity loans and lines of credit are deductible only if the borrowed funds are used to buy, build, or substantially improve the taxpayer's home. Interest on home equity loans is deductible but may be limited. Help your clients understand the tax implications of home equity loans for tax planning. Interest payments on HELOCs are only tax deductible if those funds are spent on home improvement projects. The maximum combined loan amount is. In most cases, you can deduct your interest. How much you can deduct depends on the date of the loan, the amount of the loan, and how you use the loan proceeds. The Tax Cuts and Jobs Act of affected the tax deduction for interest paid on home equity debt as of Under prior law, you could deduct interest on. Interest on a home equity line of credit (HELOC) or a home equity loan is tax deductible if you use the funds for renovations to your home—the phrase is “buy. When deducting interest paid on a home equity loan or HELOC, be sure to keep all receipts and invoices for labor and materials. You'll need them in case you. Home equity loan interest can be tax deductible if your mortgage debt is under the government maximum and you use the funds for significant home. For a home equity loan, you can deduct the interest on up to $, of the loan for married filers, or $, for couples who are married filing separately. Interest on home equity loans and lines of credit are deductible only if the borrowed funds are used to buy, build, or substantially improve the taxpayer's home. Interest on home equity loans is deductible but may be limited. Help your clients understand the tax implications of home equity loans for tax planning. Interest payments on HELOCs are only tax deductible if those funds are spent on home improvement projects. The maximum combined loan amount is. In most cases, you can deduct your interest. How much you can deduct depends on the date of the loan, the amount of the loan, and how you use the loan proceeds. The Tax Cuts and Jobs Act of affected the tax deduction for interest paid on home equity debt as of Under prior law, you could deduct interest on. Interest on a home equity line of credit (HELOC) or a home equity loan is tax deductible if you use the funds for renovations to your home—the phrase is “buy.

If you're a homeowner, you may have heard about the benefits of borrowing against your home's equity. One such benefit is the potential. How you use the money—The first point to consider is how you're planning on using the money. The funds acquired from home equity loans, HELOC tax deductions and. In the past, most homeowners with home equity loans were able to deduct the interest paid on those loans, up to $, in most cases (or $50, for married. I read that, "Interest on home equity loans and lines of credit are deductible only if the borrowed funds are used to buy, build, or. You can deduct home mortgage interest on the first $, ($, if married filing separately) of indebtedness. However, higher limitations ($1 million ($. How does a home equity line of credit work—and how can it help? · Did you know? The interest you pay on a HELOC may be tax-deductible if you use the money to buy. When you borrow money with a HELOC, you typically have a fixed interest rate. In the past, you could deduct this interest from your taxes on up to $, of. An individual may not claim a deduction for interest on a home equity debt for tax years beginning after and before to the extent the loan proceeds. In the past, most homeowners with home equity loans were able to deduct the interest paid on those loans, up to $, in most cases (or $50, for married. “Home equity debt interest is no longer deductible,” says William L. Hughes, a certified public accountant in Stuart, FL. Even if you took out the loan before. The interest you pay on a home equity loan (HELOC) may be tax deductible · For tax years through there are tax benefits for homeowners · A HELOC can. In this scenario, both of the loans (primary mortgage and equity loan) are secured by the main home and the total does not exceed the market value of the house. The IRS has now clarified that “taxpayers can often still deduct interest on a home equity loan, home equity line of credit (HELOC) or second mortgage. Are Home Equity Loans Tax Deductible? · Home equity loans after Dec 15, , qualify for a smaller tax deduction due to new limits. This limit encompasses. “Home equity debt interest is no longer deductible,” says William L. Hughes, a certified public accountant in Stuart, FL. Even if you took out the loan before. Then you can deduct the interest form the HELOC on your taxes. If you invest in a TFSA or RRSP you can't deduct. Then on your tax return. Like regular mortgage interest, you can deduct the interest you've paid on home equity loans and home equity lines of credit. However, you can only claim this. The home equity loan has regular amortization of loan principal, which is not tax-deductible. The calculator results will automatically update as you move the. If you're using a home equity loan to improve or create a home office, the interest may be deductible. To claim this deduction, you must itemize and provide. Home equity loan interest is deductible if the borrowed funds are used to build or improve a qualifying residence and contribute to the $, cap.